Yep, it’s happening! I’m returning to the workforce as an employee. After a 6-year break to work on my own projects, I stumbled on a role that just feels right. I’ve accepted the job, and started last week! 🥳

Whenever I’m talking to people familiar with my financial situation, the biggest question I get is “Why?”. It’s not an easy one to answer. We have a decent amount of savings, about $1.2m even after recent events. We have cash on hand for another ~5 years, and another 5-10 with investments. Hardcover is growing and may someday make money (🤞). So why now?

I’ll go into these in detail, but here’s where my mind goes when making this decision.

- We’re at about a 6% withdrawal rate – to high for forever FIRE.

- We don’t have any income outside of selling stocks.

- I found a job that’s so similar to what I’m already doing with my days it feels insane not to jump at the opportunity. 😂

There are also existential threats – things I can’t control but might happen.

- US stock market uncertainty throws us into unknown territory for stock projections.

- Tariffs and regulations will cause prices to rise, causing uncertainty in future spending.

- The future of the Affordable Care Act is in question, which could spike our health insurance costs.

- Fewer job openings due to a recession could make well-paid jobs scarce.

- Other countries moving away from the US dollar causing it to lose value.

Basically, my hypothesis is that stocks will go down, prices will go up, and we’re already not able to FIRE at a sub-4% withdrawal rate – in the zone we’d want. It’s a period of high uncertainty, and having a job helps some fo that. Having a job I actually like, and resonate with the mission for, makes this a no brainer.

Here’s the longer version of the those three main points.

1. A 6% Withdrawal Rate is Too High For Forever FIRE

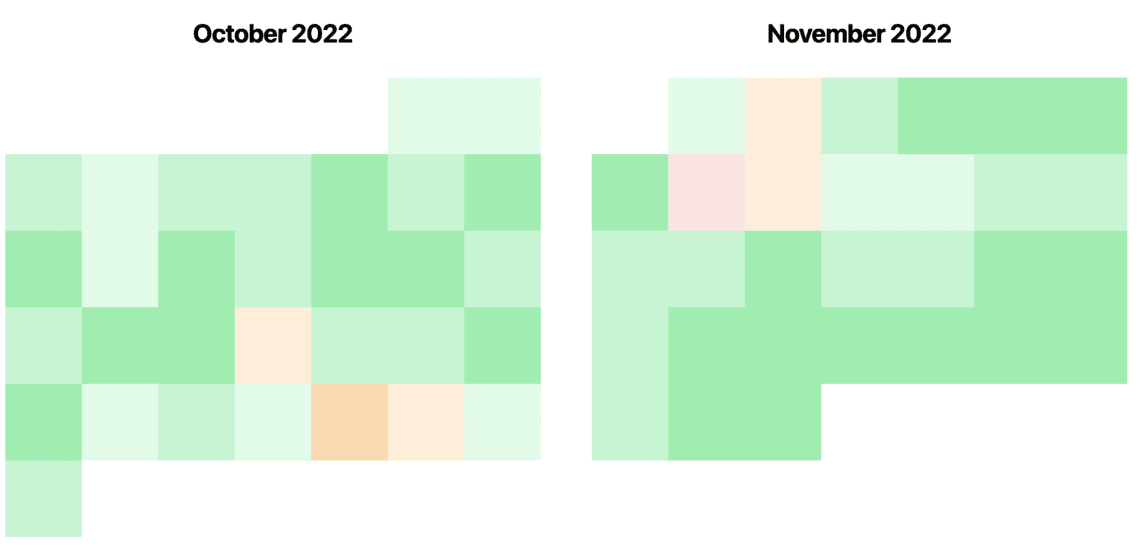

Even if you don’t know anything about how much someone has saved up, or how much they spend, if you know their withdrawal rate you know enough. In 2020 we spent $82k with $2.3m in savings – a 3.5% withdrawal rate! Things were looking good.

One big thing changed in 2020 – we stopped caring much about our spending. Getting through COVID mentally, and also enjoying life throughout the changing political landscape meant there was enough on our minds.

By 2021 our spending had grown to $104k. We bootstrapped $15 into Hardcover, and our investments continued to grow – climbing above $2.5m. This put us closer to a 4.15% withdrawal rate. Not as stable as 3.5%, but not too bad.

2022 wasn’t as rosy. Our spending grew to $133k – thanks to spending more money on traveling, bootstrapping Hardcover as a business, and the costs of knee surgery with a high deductible healthcare plan. We also lost our 14-year old dog Lily in 2022. I threw myself into building Hardcover, and stopped caring about finances. We rarely made large purchases, so I wasn’t worried about anything short term. I knew we’d eventually figure out our long term finances, and an extra $30k or so in a super-stressful year wouldn’t bankrupt us. We had at 5.4% withdrawal rate.

But somehow we spent $133k again in 2023. That did surprise me. $15k was for Hardcover, we made some luxury purchases, booked some international travel for 2024, but it didn’t feel like we were living a crazy luxurious lifestyle. We were still living in a 2-bedroom apartment, and had filled all available space from it. Our investments continued to be in the $2.3m-$2.5m range – somewhere around a 5-5.5% withdrawal rate.

By 2024, I was starting to accept the fact that forever-FIRE wouldn’t be possible with our current amount of savings and spending. We spent another $120k for about a 5.5% withdrawal rate for the year.

My wife and I had talked about this occasionally through the years, so it wasn’t a shock to either of us. We knew we could try to vastly reduce our expenses for the rest of our lives, make money now, or go back to work.

When we ran all of the numbers, that’s when we made the decision to start looking for a house. With interest rates high, my thought process was that we’d be a good buying position. Prices are high, but maybe we could find an overlooked gem, or get in fast with a good offer (we did both, and we love it!).

It’s a financial reset – one we’re still in the middle of. I don’t yet know what our yearly household spending will look like with a house. I’m guessing lower, without a $2,500 rent payment each month. My plan was to settle in, get what we need and then by June have a decent understanding of our monthly spending to estimate a withdrawal rate.

I started looking into what options we would have – besides lowering expenses. We’re happy with what we’re spending money on now. Although there are places we’d cut if needed, needed is the key word. We eat out rarely, don’t upgrade electronics often, travel enough that we’re happy with our experiences and are overall very happy.

We tried running the numbers by lowering our expenses and what we would have to cut didn’t mesh with the life we wanted to live.

2. What Are Our Income Options?

We knew our monthly expenses weren’t going to suddenly drop to a 4% withdrawal rate, so that still left the question: how do we fill that gap? We came up with three ideas:

- Hardcover starts generating income

- Rent out the 2nd unit (we bought a duplex, where I’m using the 2nd unit as an office).

- I get a job

Getting Hardcover to the point where it can generate enough income for us to continue saving money is not a quick task. Well, unless I decide to just put ads on it. It might be able to generate $3k-$5k a month with those. Our monthly spending is less than $5k, so that would cover our bills. But it could also destroy the thing I love building and alienate the community we’re trying to build. I didn’t give this more than a passing thought and decided against it.

To grow Hardcover in other ways will take much more time and work. But I’d be able to build what it in the way I want. Time wise, it’s hard to predict what that looks like – even with me working full time on it. Building out a feature is easy, but getting people to hand over their hard-earned money is another thing. Some of the features we’d like to charge for target authors – which would mean building an entire network of authors, figuring out what we even need to build, building it and charging for it. That’ll take a while.

Going into 2025, I was OK with it taking a while. As I mentioned, we have cash on hand to last a few years. That would give me a few more swings at making it profitable. I was happy to continue building it and see where things went – sitting out capitalism as much as possible for another year.

We thought about the idea of renting out the 2nd unit in our new house, but we just moved in. We’d like to enjoy it first! The 2nd unit is also upstairs, and the house was built in 1898, which means we’d hear them and they’d hear us. We’ve ruled this out for now. I see this as our “in case of emergency, break glass” kind of financial situation. It’s always there if we need it.

That just leaves one option.

3. The Part Where I Get a Job

Then in the span of a month four things happened:

First, I saw a job posting about a research and development position at a technology education company that sounded fun. It mirrored much of what I did at Code School for years and got me excited at the idea of working again. I applied for it, heard nothing for 6 weeks, then received an form message saying they were moving forward with a different candidate. 🤷♂️

Second, a few weeks later, I attended Epic Web Conference here in Salt Lake City. It was a ton of fun! I was able to put many BlueSky names to faces (side note: I’ve migrated from Twitter/X/Mastodon to BlueSky. I’m @adamfortuna.com on there). It was only the second tech conference I’ve been to since COVID lockdown, and I had a ton of fun building a hack day project (Birdcatcher, an intentionally awful video player), and chatting with other devs.

One common thing at tech conferences is companies looking for developers. It’s an ideal place to find motivated devs who care about improving. That hiring piece was missing from this conference experience. I chatted with at least 4 developers who were actively looking for jobs and struggling to find a position. The pattern-matching side of me noted this as a not-great-sign for the state of software development jobs.

Third, the stock market saw the largest drop since the pandemic. We didn’t make any notable changes in our portfolio, since we had previously rebalanced (to 20% US / 25% International / 20% bonds / 30% cash) by selling funds to purchase the house. That rebalance was based on us not having jobs, but having cash on hand for the next few years. We made one change with the market drop: selling some funds in our (very small) HSA so have more more in cash there.

The Fourth, and the catalyst of this entire post, happened completely by chance. I was working on Hardcover and browsing BlueSky one day and saw a job posting at Libro.fm for a Senior Ruby on Rails Engineer. I’ve been a Libro.fm user for 4 years, a Rails engineer for 20, and I’m building a social network in the book space. Libro is an audiobook competitor to Audible in the same way Hardcover is a social network competitor to Goodreads. I applied, not fully committed to the idea of going back to work (yet).

Researching Libro as a company, I was more impressed at every step. They’re bootstrapped, remote, employee owned, a Social Purpose company, and pay well with a small team (under 20). Every new thing I learned about them made it clear they’re building the company with many of the same principles I’ve built Hardcover with – but they’re much more financially successful. 😂

Within a week they got back to me and I interviewed with a few people on the team. Each person I talked to made me more excited to work with this group on this project. By the time I talked to Mark, Libro’s CEO, I’d switched from wondering if this would be right for me, to looking forward to seeing how I could help make even more of a difference in the book space.

Aside from the empathy and communication that I experienced during the interview phase, I was amazed at how well it could just fit into my life. I’m already working ~32 hours a week on Hardcover, waking up early and juggling 20 things at a time. This will shift that to working entirely on in the code. Someone else will get to handle marketing, support, product research, and a bunch of other tasks that come along with being a founder of a startup.

That doesn’t mean I’m leaving Hardcover! In fact, I’m still working on it one day a week plus nights and weekends. In our next newsletter on May 1st, we’ll be announcing some changes, but that’s mostly our hope to bring on some new team members and focus on shifting to open source. I’m just as committed to the project as ever. If anything, it means that spending a little money of of my pocket to keep it going doesn’t mean robbing my future retirement.

The First Week

My first week happened to be their yearly offsite, and I was able to meet the team! So far it feels a lot like a bunch of people who kept their college team projects together all working at one place. 😂 I’m excited to get up to speed and start making contributions that help even more people read more – a spillover of Hardcover goals I’ve been working towards into Libro.fm’s.

I’m not sure yet how much I plan to write here on Minafi, about my finances, or about Libro. I felt burned out on financial content in 2021, which is what led to my shift to Hardcover in the first place. I’d still like to share occasional updates here, but