There are a few core concepts that once you understand, investing becomes easy and just starts to make sense. When I started investing it was with a financial advisor. Although they charged a fee based on assets under management, there were a few concepts that this advisor took the time to drill into me. Those 4 concepts are:

- The power of compound interest given time

- The drag on your portfolio that fees can have

- The benefits of tax-efficient fund placement

- The importance of diversification for risk management

I talk about all of these and more in my free investing course, The Minimal Investor, which guides you through everything you need to know to invest confidently for the rest of your life. You can read the course here on Minafi, or read it with a weekly email by signing up below.

The one of these I’ll be digging into today is #4 – diversification.

My “aha!” moment for diversification was when I looked at the table below – specifically the “You” category. Notice how it’s never the biggest winner or the biggest loser? That’s the power of diversification!

When I saw that some sectors of the economy do very well some years and others do well in other years, I first wondered if I could just pick the winners. It’s possible, but the odds are against you (more on that later). If you had all of your money in any one sector of the market, then you’d see wild swings.

The solution? Diversification! For that, take a look at the darkest block on this chart. That represents a diverse portfolio that includes a number of assets behind the scenes. Check it out the visualization below and try changing your custom asset allocation and see how it impacts your returns over time.

A Diversification Primer

There’s a LOT to go over on this visualization, so we’ll take it one step at a time.

To understand diversification, the first step is to get an idea of the types of things you can invest in within the stock market. If you’ve ever browsed Yahoo Finance, or read the business section of a newspaper, you’ll know there are thousands (or hundreds of thousands) of things you can invest in. At a high level, your stock market investment options can be reduced to a handful of groupings:

- Individual stocks (600,000+) – Investing in a specific company. These can go up through the roof, or go down to nothing.

- Bonds (1,000,000+) – Buying debt from a company or government. They pay off the debt and pay interest to the bondholder.

- Cash/Certificate of Deposit – Storing your money at a bank in a savings account or checking account and (possibly) earning interest.

- Mutual funds / ETFs (2,000+) – Investing in a single fund that then invests in hundreds/thousands of stocks.

- Market Cap Funds – Fund that invests in a group of companies based on the market cap of the companies in it (ex: S&P 500 Index).

- Sector Funds – Fund that invests in a group of companies based on what the company does (health care, technology, finance, real estate, etc).

- Bond Funds – Fund that invests in bonds from companies and governments.

This isn’t an exhaustive list of places to invest, but it’s a good place to start. Investing in individual stocks and individual bonds is doing investing on hard mode. When going that route, you need to fully research and vet the company, understand their financials, forecast their potential upsides/downsides, research their competitors – it’s a lot. You also may need to continually do this, since companies are always changing. There’s a place for this type of investing, but my recommendation is that this shouldn’t be the first place you invest money. For that, go with mutual funds and ETFs.

If we narrow the millions of investment options down to only ETFs and mutual funds then that’s a good start! Deciding which one (or ones) to choose can still be a tough decision.

My personal investment style limits these mutual funds one more step: low-fee index funds. An “index fund” refers to a mutual fund/ETF where the investments in it are chosen by a computer or formula. This is the opposite of an “active fund” where the fund decisions are made by a human.

If you filter all Vanguard Funds by only ones with a “management” of “index”, then that brings us down to 62 potential funds to invest in! That’s much much easier than researching 1 million funds, right? The funds featured above are the

The Role of Risk

If you had all of your money in cash, you’d have a very low risk of losing your money, but you’d also see an extremely low return on your investment.

On the other end, there are investments that are considered “riskier” and “less risky”. One way to measure risk is to calculate how much the fund fluctuates. The more it fluctuates, the riskier it is.

For example, take two funds with the following returns of the last 5 years:

| Fund 1 | Fund 2 |

| 40% | 12% |

| -50% | 8% |

| 30% | 11% |

| 20% | 9% |

| 48% | 10% |

If you had invested $10,000 in both of these funds 5 years ago, you’d have almost the exact same returns now.

But what if you joined fund 1 after the first year? In that case, the returns from fund 2 would be 30% higher!

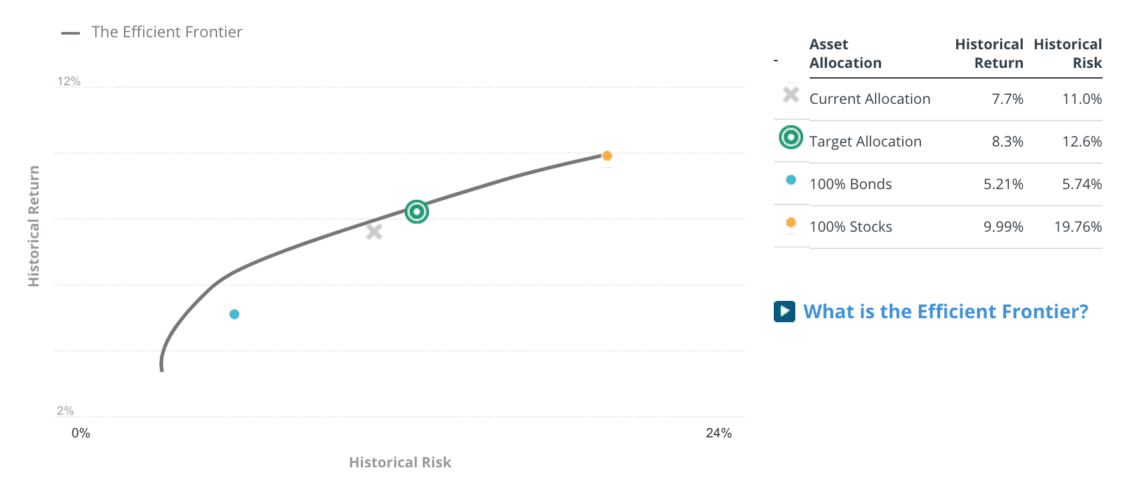

The takeaway here is clear: don’t chase the best returns. If you could get the same amount of returns with less risk then that’s a win/win. I always go for the highest return for the amount of risk.

You can calculate your risk yourself, or you can use a free tool like Personal Capital to do it for you.

Be Careful How You Use This!

There are a few things to mention before you go off and invest based on this data:

Don’t Assume Past Performance Will Continue

This one is the most obvious, but also the most important. If you invested in emerging markets after their increase in the mid-2000s, you would’ve seen your investments drop in the years after. The same thing happens all the time. In the 1970s bonds were way up, but have returned very little recently. Real estate went way up only to be the lowest performers in the following years. US stocks have been through bubble after bubble – including the dot com bust, the great recession just in the last 20 years.

The takeaway here for me is to be mindful of the risk/reward graph. If you’re investing in something that’s historically way above the risk line, then it’s not unexpected if falls far below it. Likewise, something below it could easily jump way above it. There are no guarantees in investing for a single fund, but if you are invested in a number of things then you can guarantee that your returns will be somewhere in the middle.

I’ve been pitched by a number of financial advisors and “experts” who claim they can continually get 12% returns in future years. Never trust someone who can promise future returns. They may be able to declare they’re done well in the past, but be sure to independently compare those results to your own saught out baseline. Often, they’ll compare their “amazing” returns to a fund that has underperformed. Seek out an index fund to compare with the returns and judge their claims for yourself.

Plan Long-term, Don’t React to Trends

Imagine for a moment that you bought the fund that did the best each year and held it for the next year. For example, on January 1, 2005, you put all your money in a REIT fund. Then on January 1, 2006, you sold it all and put all your money in an EM fund. What would your returns look like after 15 years? Does the fund that did well in the previous year do well in the next year?

Actually, let’s take it a step farther and compare that with a few other portfolio strategies over 14 years, starting with the 2nd year on the grid above. Here are the scenarios we’ll look at:

Trend Follower: What I mentioned above. Every year they sell everything they have and buy whatever performed best during the previous year.

80/20 Diversified Portfolio: A portfolio consisting of 20% bonds, 48% US and 32% International.

Lucky Investor: On January 1st of each year, they sold everything they had and bought into the fund that did the best for the following year.

Unlucky Investor: On January 1st of each year, they sold everything and bought the fund that performed the worst the following year.

| Avg Return | Growth of $10,000 | |

| Trend Follower | 2.19% | $9,729 |

| 80/20 Portfolio | 8.27% | $31,078 |

| Lucky Investor | 26.34% | $227,942 |

| Unlucky Investor | -8.47% | $2,296 |

Wait, what? The trend follower had a 2.19% return but they lost money? That doesn’t make sense. Well, it does – because average doesn’t include the sequence of returns being applied. The trend follower would’ve seen their money grow from $10,000 to $14,922 in the first 2 years – amazing growth! After that, they’d lose 52% of their portfolio in a single year and it wouldn’t recover during the 14-year span.

The 80/20 portfolio requires the least work of every portfolio on this list. Each year, you’d need to rebalance your portfolio by selling some funds and buying others. For instance, if your portfolio was 82% stocks and 18% bonds after one year, you’d sell 2% of your portfolio that’s in stocks and rebuy bonds. For this visualization though, it does not take that into account. If you practiced that reallocation, then the actual returns would have been lower. This assumes you put the money in on the first day and let it ride from there. This 8.27% return assumes you put your money into those funds on January 1, 2015, then don’t touch it again for 14 years.

The lucky investor saw their funds increase at an amazing rate! Who would’ve thought, right? But what are the odds of picking the best fund 14 years in a row? With 8 funds to choose from, the chances are 8 to the 14th power or 1 in 4,398,046,511,104. Yes, that’s 1 in 4 trillion. This is why you should not rely on picking the winners. Also, the absolute best case here doesn’t make you instantly rich! In both cases, you’ll need time on your side.

The unlucky investor does about as well as you’d expect. They lose 88% of their initial investment over 14 years. Surprisingly though, they experience 9 years of growth! That’s mostly because the last decade has been an absolute boom for investing. Almost anything you invest in would make money if you kept your investments in them. Just look at the original graphic above – every single fund went up over 15 years! Where you get into trouble is when you decide to drastically switch course and not have money in the markets.

The takeaway here is clear: don’t overthink it! You can nitpick your asset allocation and drive yourself crazy, or create a plan and let it ride.

Don’t Over-Optimize

When I started investing, I played with the numbers to try to create the “optimal” portfolio. For me, this meant putting a little bit of my portfolio into a small-cap fund, some into a REIT, some into emerging markets and some into individual stocks. The returns on this? Roughly the same as if I had just put this into US, International, and bonds.

It can be fun to try to figure out how to improve your portfolio, but keep in mind you’re doing it on past performance. Coming up with the best solution for the past 15 years isn’t going to provide the best returns for the next 15 years.

Where you can optimize is in its efficiency! Develop an asset allocation that you can easily track and understand. I use Personal Capital to analyze my portfolio and understand if my asset allocation matches my target. If it doesn’t, I’ll rebalance to get closer to that.

Note: My asset allocation is way off my target right now. I’m waiting to finalize taxes before sinking a bunch of cash into international stocks.

How Should You Diversify?

Once you have a solid understanding of how diversification works, there are a few more steps to take before applying the principles here. Pick the next step that feels right for your situation:

If you’re currently investing with a financial advisor, then learn about what your current asset allocation is. Are you diversified? Are they heavily invested in one stock or sector? Talk to your financial advisor and ask why. Ask them what the risks are of your asset allocation. Ask them how this portfolio compares with a diversified portfolio – and then do the legwork to find out if this matches reality.

If you’re currently investing with only a 401k, then you’re in luck! You can apply the information from this post right now in that one account. Try looking for a good US Large Cap fund in your portfolio, an international fund, and Bond fund. You can also start with just a US Large-cap fund and a bond fund. You’ll want to look for ones with low fees. In many 401k plans, this may be an “S&P 500” index fund or a “Russel 1000/3000” fund.

If you currently have multiple investment accounts (401k, Roth IRA, Brokerage), then you have some homework ahead of you before you make any changes. I’d read up on tax-efficient fund placement as a next step. The idea here is that each type of fund (US Stocks, Bonds, etc) will do the most good in a specific type of investment account. For example, bonds are best in a 401k. There’s a lot to unpack on this, so check out that article for more.

Keep it simple.

If there’s one takeaway from this article is that’s diversification doesn’t have to be difficult. It can be as simple as investing in a single target-date fund or creating your own asset allocation. If you’re currently investing already, learning about what you’re investing in is a great step that can lead to more confident decisions down the line.

About this visualization: This was a passion project that I programmed using D3.js and data provided from Vanguard’s website. I’m looking for what kind of visualization to create next! If you have an idea and would like to partner together on something, feel free to reach out!

Love the interactive visuals! So cool! One of my favorite posts yet 🙂