Hey hey, and welcome back to lesson 5 of The Minimal Investor!

Hard to believe we’re halfway through the course! If you’re enjoying this course, please share it with others who might find it useful (that would make me very happy! :). If not, I’d encourage you to contact me with ways I could make it

Past Lessons Recap

We covered a lot in the first 4 lessons. In this lesson, we’ll walk through the process of purchasing a mutual fund on Vanguard. But first, let’s recap the top points of this course so far.

Lesson 1 – Accounts: Getting a hold of your accounts, and opening a 401k and/or Vanguard Account. This is the account we’ll be using this lesson for making a purchase.

Lesson 2 – Diversification: Understanding of what diversification means and how it can help. We’ll be purchasing with this allocation in mind.

Lesson 3 – Fees: How fees can mess up your plans and how to choose funds that won’t screw you over.

Lesson 4 – Tax-Efficient Fund Placement: Once you have diversification and fees down, taxes are the next biggest concern. We looked at which accounts (tax-advantaged vs taxable) you should be putting which types of funds.

If you’re nervous about that, it’s understandable! It takes a lot of buying and selling funds for that to go away, but with practice and understanding of what you are doing, it goes away.

Lesson 5: Buying Funds

For this lesson, we’ll jump right in and go through two processes: buying mutual funds and buying other funds (ETFs). These are very different things, but depending on where your brokerage account is, your experience will likely be one of these two.

I strongly suggest going the mutual funds’ route through Vanguard. I recently wrote up an article on Minafi about the difference between mutual funds and ETFs that helps explore why I believe this to be a better choice. The more I look into ETFs vs Mutual Funds, the stronger my opinion becomes that Mutual Funds are a no-brainer.

Here are the topics we’ll be covering in lesson 5 to get there:

- Buying mutual funds through Vanguard

- Buying ETFs through Vanguard

Let’s get right into it!

Buying Mutual Funds Through Vanguard

This will be a screenshot heavy lesson! I’ll walk you through where to click and what each page means.

I’ve walked through purchasing Vanguard funds with Mrs. Minafi, and came to realize these screens are very confusing the first time you use them. My hope here is to highlight the important parts.

1) Getting to the “Buy & Sell” Page

We’ll be in this “Buy & Sell” section of Vanguard today. To get there, click on “My Accounts” in the header, then on “Buy & Sell”.

2) About the “Buy & Sell” Page

This page can be crazy confusing the first time you see it. 99% of the time when I access this page I click the very first link – “Buy Vanguard Funds”.

I’ve highlighted what I’ve found to be the most useful links on this page. Right now we’re buying Mutual Funds, so we’ll go to that first link.

3) Choosing a Vanguard Account

Once you click in to buy mutual funds, you’ll need to decide which Vanguard account to put them in. If don’t have any Vanguard Accounts, you’ll need to open one first.

4) Click the checkbox next to “Add Funds”

In order to choose which funds you want to add, you’ll need to click the checkbox next to “Add another Vanguard Mutual Fund” (not the best UI I know). You’ll only need to click this when you’re adding a new fund to the list. If you have already invested in a fund (like the 4 you see below in my account) you don’t need to add another new one.

5) Enter the Fund Name

Enter the fund name you researched and want to buy first. I recommend starting with the Vanguard Total Stock Market Index Fund.

Update! You no longer need to choose between $VTSMX and $VTSAX based on how much you invest. You can invest in $VTSAX with only $3k now. There’s no reason to ever invest in $VTSMX.

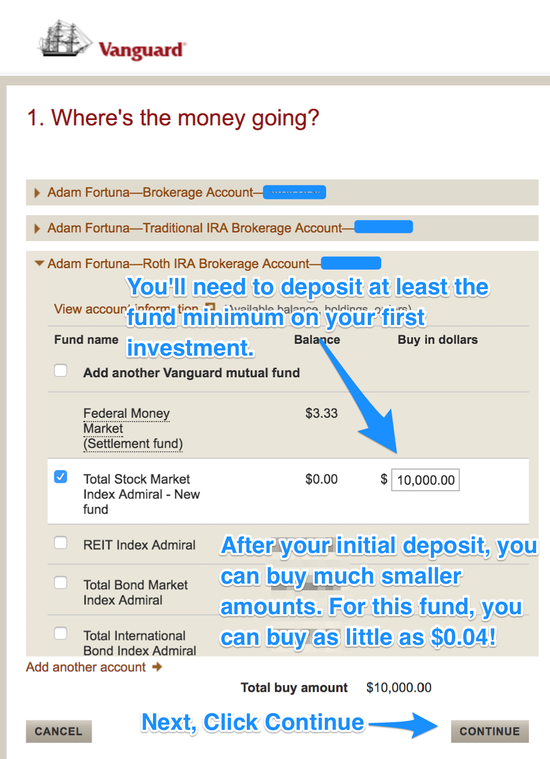

6) Enter the Amount to Invest

Enter how much you want to invest in this fund. This amount will need to be attributed to a single funding source (like a bank account transfer).

7) Select Funding Source

You’ve done the hard part! You’ve selected the funds you want to invest in! Give yourself a pat on the back.

Next, you’ll just need to let Vanguard know where the money is coming from. This will mean connecting Vanguard to your bank account so it can withdraw funds. I mentioned this in lesson 1 since it takes a little while to set up. If you’ve been following along, you’ll have it available! If not, you’ll want to add your bank account before completing the fund purchase.

8) Confirm the Transaction

Once you submit, you’ll be taken to a confirmation page to make sure everything looks right. Once you’re confident, your numbers are correct, hit submit! At that

And that’s it! You’ve made a Vanguard Mutual Fund Purchase. Not too many steps right? To me the hardest parts of this entire process are:

- Picking your funds! With fees, taxes, and diversification this can be tricky.

- Linking Vanguard to your Bank. It can take a few days.

- Learning where to go on the Vanguard Website.

The great thing about these three things is that you only have to do them all once. You won’t need to pick new mutual funds each week, or link a bunch of bank accounts. Even Vanguard’s interface becomes familiar after a few months of use – and they rarely change it.

This is all good news because it means once you understand these three steps you’ll be able to invest for years to come!

Buying ETFs Through Vanguard

I’ve been going back and forth on if I should even go into this topic. If you’re using Vanguard I wouldn’t recommend ETFs, but if you’re on a different brokerage, you might have other reasons to go that route. Here are my top reasons for using Vanguard Mutual Funds over Vanguard ETFs.:

- Mutual Funds allow automatic investment (ex: put in $1,000 each month after I get paid), ETFs don’t.

- Mutual Funds allow any investment amount (ex: $1,000), ETF investments may be required to be divisible by the fund value (ex: $131.04).

- Mutual Funds are priced once for the entire day. That means I get the same price as every other investor. ETFs fluctuate every second. Your purchase might go through during a spike or drop during the day.

I’ll go over the ETFs buying process, but mostly to demonstrate how AWESOME the Mutual Fund process is in comparison.

1) Head back to the “Buy & Sell” Page

To invest in ETFs, we’ll be on the brokerage side.

2) Select Trade Options

Buying Vanguard ETFs is a similar process to buying stocks. You’ll provide a symbol, a number of shares, and special order instructions. Depending on the order type you choose, different fields will be shown in the order form. Going over the ins and outs of these order types could be a course on stocks alone.

The tl;dr for these order types comes down to a few points:

- Day traded funds change prices constantly (many times a second).

- These options allow flexibility so you can purchase when specific conditions are met:

- The price hasn’t risen or fallen too much (limit order)

- The price has risen or fallen by an amount (stop order)

- The price has risen/fallen by a set amount, but it hasn’t risen/fallen too much (stop/limit)

- I don’t care, just buy it (market order)

Side note: $VTI is ETF equivalent of the mutual fund $VTSAX. They are both fundamentally the same. $VTI has an expense ratio of 0.01%, but that advantage is offset by the inability to automatically invest.

Honestly, for retirement investing, all of this is too much to worry about every month or every paycheck. Do you really think you’ll invest more if you need to log into Vanguard to manually go through this buying process after every paycheck? I don’t.

The less I have to do to make an investment, the better. This is why more Americans invest in 401ks than in any other investment account – they’re just easy. Can you imagine how many people would skip investing in a 401k if they saw the above form?

If you’re on the fence on ETFs vs Mutual funds – don’t be: just go with mutual funds. That’s an easy decision.

Lesson 5 Review

We went through the entire process of making an investment in Vanguard! If there’s one takeaway from this it’s that making an investment on Vanguard is actually super-easy. Again, Vanguard doesn’t offer any affiliate program and I’m not making money off recommending them in any way. It’s where I personally invest, and where I believe you could make the most money by investing.

Next Lesson

In the next lesson, we’ll look into some strategies for tracking your investments. This allows getting a good snapshot of how you’re doing.