In the last 7 days, Bitcoin is up 54% as of this writing, although it peaked at around 90% up week over week. You read that right: up 90% IN A WEEK. After watching Bitcoin for the last 7 years, this doesn’t seem as crazy as it should. Right now a lot of people are thinking about how to get started investing in Bitcoin. After using it for over 4 years, I’m going to do a Coinbase review and also help answer some of the most common questions about Bitcoin.

The big question(s) right now that is on everyone’s mind is the same: “Are we in a bitcoin bubble?”. Well, yeah we are, most people can agree on that. But also, “When will the bitcoin bubble burst?”. Also, what will happen when it does?

Let’s be honest here — who wouldn’t want to invest in something that goes up 2000% in a year? Although it’s tempting to invest in high performing assets, there’s always the caveat that past performance is no guarantee of future performance. If you’re tempted to invest in Bitcoin, I’ll share my personal strategy speculation:

Don’t invest more than 5% of your total assets in speculative assets.

This is my personal mantra for investing. It’s easy to say, but at a time when Bitcoin is up 90% week over week, I do wish I invested more. Bitcoin is a part of How I Would (and Do) Invest $1 Million, albeit a very small piece. I’ve found that my personal investing strategy is to only put money into things that allow me to sleep at night. If I was investing 100% (or even 25%) in cryptocurrencies I would not be a sound sleeper.

With that caveat aside, let’s talk about Coinbase and how you can use that to buy bitcoins, sell bitcoins and exchange bitcoins.

Coinbase in the App Store

With Bitcoin in the news and up so much week over week, it’s no wonder that Coinbase is #1 in the iOS app store today is Coinbase. If you want to exchange dollars for Bitcoins the app or the website is the most above-board way to do it.

If you’re looking to change actual physical dollars into bitcoin today, you’ll probably want to skip Coinbase and just run out to the nearest Bitcoin ATM. Learning to use a Bitcoin ATM is out of the scope of this article, but you’ll probably want to use the Bread App for that.

I prefer to use the Coinbase website over the app myself, but that might be because I generally prefer computers for anything that takes over a minute. Either way, you can set up an account on Coinbase and get started.

Coinbase Account Setup

Once you your account created, you’re going to have a few hoops to jump through before you can make any purchase. This includes:

- Setting up 2-factor authentication with an application like Google Authenticator

- Confirming your phone number with the usual text message / “type in this number” dance

- Uploading your driver’s license or other ID to verify your identity.

The identity verification step is annoying, and will potentially take hours to days. If you’re going to be discouraged because you want to buy bitcoin today and you can’t because of this step, you can probably stop reading right here. The reason Bitcoin does this is due to some US laws.

After your identity is verified, you’re good to go, and can start buying a very small amount of bitcoin, ethereum or litecoin!

Coinbase Buy and Sell Limits

Coinbase doesn’t mention exactly what their limits are in their documentation, but if I remember right it was something along these lines when I first opened my account:

- $500 weekly limit on Credit Card purchases (instant)

- $1,000 weekly limit on Bank transfer purchases (delayed)

- $2,000 weekly limit on USD Wallet purchases (also instant, which is your cash account on Coinbase)

Your limits will be dependent on what verification methods you enter in. The more information you provide about yourself the higher your initial buy/sell limits will be.

Reducing Mass Speculation

If you’re looking to become rich using Bitcoin, you’ll probably see why that’s not going to be possible with these limits (unless you have a time machine). Coinbase has been very deliberate with these limits. From a Bitcoin ecosystem standpoint, I think it’s an amazing idea. It prevents people from jumping in and speculating outrageous amounts on a whim.

Instead, when there’s a week like this past one where the price spikes, it’s likely driven by a huge number of people investing in Bitcoin. This is actually good news because having more people with smaller amounts of money means the swings happen based on entire populations, rather than a select few large holds (although, that’s likely still a concern).

Your limit on Coinbase will increase over time after a number of purchases.

How Bank Transfers Work on Coinbase

The “Bank Transfer” category on Coinbase is very odd but makes sense. If you have a new Coinbase account and you link it to your bank account, you’ll be able to buy Bitcoins. Unfortunately, it’s not instant. If you buy Bitcoins right now from your bank account, the price you’ll get for the Bitcoins will be whatever the price is when Coinbase receives the money from your bank — typically a few days from now.

This means that if you buy Bitcoins in this way, you won’t know what price you’ll be paying for them, because you won’t have control over what the price is when the transaction goes through. You can get around this by transferring money from your bank account to Coinbase USD Wallet (which is your cash account on Coinbase), then making instant transfers. Moving money from your bank to your USD Wallet will take the same amount of time as going from your bank to Bitcoins though.

Buying Bitcoins Instantly With Bank Transfers

After you’ve successfully completed a bank transfer and waited another 30 days, you’ll be able to make instant Bitcoin purchases from your bank account. Coinbase will effectively “lock in” the price of the coins at the time you initiate the transfer, but you won’t actually receive them until your bank transfer hits Coinbase.

The fact that they’re able to do this is actually quite insane if you think about it. It means that Coinbase is setting aside coins for you without having your money. They’re taking the risk that the transaction will be successful and eat the cost if it’s not (in the form of reserved bitcoins that they can then release and sell to someone else).

Coinbase App Walkthrough

After your account is all setup, you can go through the process to buy some Bitcoins (or Ethereum/Litecoin). The process once you’ve linked your account is as simple as going to the buy screen, entering in an amount, clicking buy, then confirming the purchase.

Here are some screenshots of the Coinbase iOS App.

The Charts views shows your current Coinbase balance and charts of BTC, ETH and LC.

Your address

Price alert

Coinbase Fees

Buying Bitcoins on Coinbase isn’t free. The pricing and fees page isn’t easy to understand. You’ll usually be hit with somewhere between 1.49% and 3.99% in fees for making a purchase on Coinbase. If I was to buy $25,000 from my bank account, I’d pay $367.03 in fees, or 1.49%. This is no small chunk of change, but that’s the cost of getting coins instantly.

Coinbase Review

I’ve been using Coinbase for 4 years at this point, and I’ve been impressed by their offering. They’re the most professional Bitcoin exchange I’ve seen, and they’ve nailed the user experience more than any other application out there. I hadn’t started putting any notable amount in it until this year, so sadly I’m no bitcoin millionaire.

My personal stake in Bitcoin is up over 100%, but it’s still a small enough amount that it’s not going to impact any of my long-term plans. I stopped buying more cryptocurrencies when they hit 5% of my total portfolio, but they’ve continued to climb since then. I’ve been curious to start a donor-advised funds account, and now that Fidelity accepts Bitcoin for their DAFs, it could be a great win-win to do with all of this growth.

Moving Coins to a Hardware Wallet

I have learned one thing that helps me sleep better at night though – how to secure my Bitcoins in a hardware wallet. Imagine if tomorrow Coinbase disappeared – you’d be out every cent you had there. If you have more than a months salary in Coinbase, I’d recommend spending the $100 and buying a good physical wallet and learning how to use it. I recently picked up a Trezor Bitcoin Wallet, which has been incredibly easy to use. I understand what it does, but I’m still fuzzy on how. once I have a better understanding of it, I’ll write a review.

Tracking Bitcoin With Personal Capital

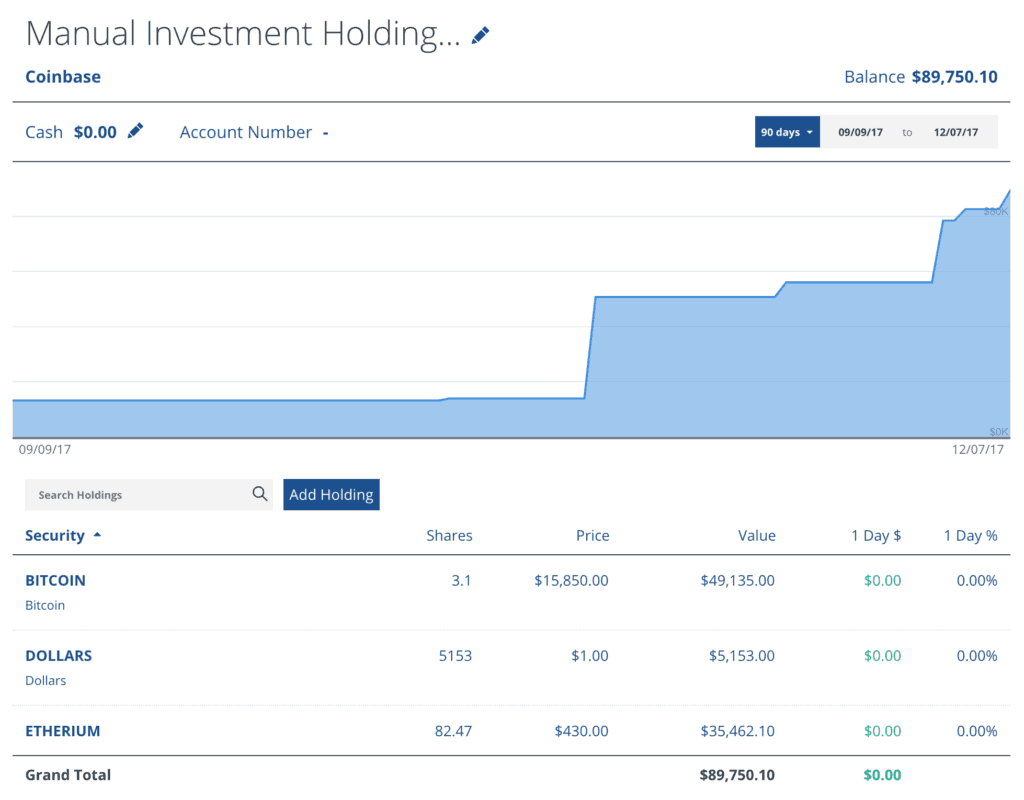

I use Personal Capital to track all of my investments and spending over time. Coinbase offers an API for sites like Personal Capital to get your account information without being able to do anything dangerous like buy or sell coins. Unfortunately, this feature has some issues and doesn’t currently work.

But don’t despair, there’s still a way! Personal Capital has a “Manual Investments” section where you can type investments in. I’ve been using this to track the value of my Coinbase account over the last few months.

It’s a manual process to change the price of BTC and ETH, but it does allow tracking the value over time.

Should You Use Coinbase?

Coinbase is the killer app for Bitcoin investing, and this week a lot more people found that out. If you’re going to buy Bitcoin to invest in it, Coinbase is your best bet. I’d recommend it to anyone getting started with Crypto as a gateway to getting started. If you’re going to use it though, consider dollar cost averaging Bitcoin, using a physical wallet and learning how to secure your funds.

I’d encourage you to use my Coinbase affiliate link from this post. If you use it to sign up, then buy or sell $100, we’ll BOTH get a $10 credit. How cool is that?

Sending Money with Coinbase

Once you’ve used Coinbase and want to try Bitcoin for what it’s actually used for (as a currency rather than an investment) you may want to try sending money to someone. If you’d like to try sending money from the Coinbase app, I’ll happily volunteer my account! You can send money to 19wo5e4MdSRVeo7J8eJejKEAbCMM2Gkye7 or the QR code on the right.

If you try sending an amount to this address, even $1 you’ll notice something interesting — a “network fee”. This fee isn’t a Coinbase fee, but a fee that would go out to miners who are helping to process your transfer. Luckily, if you’re a Coinbase user transferring Bitcoins to another Coinbase user, Coinbase won’t charge a network fee.

Next Steps

If you’re curious to dip your toe into cryptocurrencies, Coinbase is a great place to start. If you’re curious to know what all the buzz is about, try downloading the app. For me, I’ll continue investing 5% of my portfolio in cryptocurrencies, and leave the remaining 95% in low-cost index funds. If you’re wanting to learn about Bitcoin, the blockchain and how it all works, a friend and former co-worker of mine from Code School recently started a bitcoin and cryptocurrency newsletter that’s worth subscribing to.

Rebalancing a portfolio with Bitcoin or figuring out how to donate some of my crypto-profits is a subject for another day!

Have you invested in cryptocurrencies? Why or why not? If there was a stable, non-government associated currency, would you use it?

You’ve got a great strategy here with 5% – part of my concern with Bitcoin is that by and large, most of the people I hear about being interested in it now have little to no other investments. They’re banking EVERYTHING on Bitcoin because it’s the hot buzz word this month.

Keeping it to a small percentage like you are is the right way to invest in anything that’s considered speculative like this. And hey if it all goes to $0 then at least you got some enjoyment out of it in the meantime?? 🙂

Do you have any plans to sell as part of general portfolio rebalancing??

Whenever I hear about someone going all in on Bitcoin, I’m both incredibly scared and incredibly jealous (well, this week — we’ll see about next week). I don’t have the stomach for that, or the confidence in the strategy long-term.

As far as rebalancing goes, that’s a big question for me right now to figure out before the end of the year. Bitcoin is now more than 5% of my portfolio (closer to 8%). I try not to rebalance unless things are about 5% out of whack, choosing to instead rebalance by just investing more in lower areas which usually works out. I suspect between moving some coins into a donor advised funds + buying more from my general savings rate in low areas it’ll balance out without needing to sell coins and rebalance.

Funny. I just purchased my first $25 of BTC on Dec 1!

By the time the transaction went through, I had $37 worth >_<

The ride is insane. You see the Time piece about the hackers though? Published last night I think.

Oof, I hadn’t heard about that, but just read it was a $70 million dollar theft. This is the reason I recommended moving things to a hardware wallet if you have any significant amount of coins. If your coins are in the control of someone else (either Coinbase or NiceHash in the case of the theft), you’re at their mercy the same as a bank — only without the FDIC guarantee.

With a hardware wallet, I could lose the actual device, and lose my computer, but I’d still be able to restore my Bitcoins using a 24-word phrase (written down on physical paper). Now, that means if I lose my computer, my wallet AND that 24-word phrase then I lose 100% of my coins. It all depends if you want to rely on an exchange to not mess up or rely on yourself to not mess up. There’s big risks in both cases for sure.

I just got done reading a mainstream article that Coinbase has been crashing lately due to the volume of transaction. I’m curious if your seeing this. Trading bitcoin is not my cup of tea but I am enjoying rubber knocking.

I haven’t seen that, but I did read about it. They were down for 6 minutes and it impacted the price of Bitcoin worldwide. That is extremely concerning overall too. Kind of like if the NYSE was down having Japans economy crash.

An easy way to get around the fees is to deposit your USD to Coinbase, then go to Gdax.com and deposit your USD there (For free and instantly as GDAX is Coinbase’s trading exchange) and then place a limit buy order. It’s saved me hundreds of dollars over the year.

Nice! I’d read some about that to mixed results. Do you know if you can still do instant purchases that way? or would it be a delayed trade?

Great review of Coinbase. First one I’ve read. I used Coinbase to get started but have also tried Kraken too which was good though not as user-friendly to someone new to the game. Completely agree with your 5% rule, and I follow the same strategy.

Have you used Bittrex before and done any research on altcoins? Curious to know if other people are just speculating on the “Big 3” or getting involved in other blockchains as well.

Also, thanks for the advice on Personal Capital’s manual investment feature!

Coinbase is a scam anyone that tells you differently is making money off of you you are more than welcome to give them all of your information including your bank account and they will happily withdraw your funds and allow you to seemingly by the cryptocurrencies they offer the problem comes whenever it’s time for you to sell and withdraw from them that’s when everything goes off the rails they never allow you to withdraw your funds there’s only one phone number you can contact them and they tell you there’s nothing they can do for you and there is no other phone numbers to contact a real legitimate business has contact information so that problems like this can be resolved when the business is structured intentionally so that you cannot reach them it is nothing more than a scam and no one should ever fall into the Trap of using coinbase

I have been using coinbase and my account holding a balance of 2.5 BTC got closed for no reason and I have read so many comments about them being scams and all. And moreover, coinbase charge too high fees. And then I switched to using coinfix. A platform that I could buy and sell bitcoins and even exchange them. They do not have a wallet service, so I use my private trazor wallet. Coinsfix allows me to exchange these cryptos without any fees and I can buy and sell without ID verification. In my own opinion, I think coinsfix is a better service but I would like to know what you gusy think. Please drop your opinions.